The phrase, “more bang for the buck,” is usually associated with the Vietnam War. It is associated with Defense  Secretary Robert McNamara’s focus on statistics: military expenditures vs. enemy deaths. This was his infamous “body count.”

Secretary Robert McNamara’s focus on statistics: military expenditures vs. enemy deaths. This was his infamous “body count.”

In fact, the phrase came from Eisenhower’s Secretary of Defense, Charles Wilson. He used it in 1954 to justify the Defense Department’s reliance on nuclear weapons rather than conventional armies. McNamara’s focus on armies was a reversal of Wilson’s context.

In 1953, Eisenhower gained a stalemate in Korea: a ceasefire. There has never been a treaty ending that war. In the decade of 1965-1975, in a much longer war, the United States lost. Today, the United States has lost the war in Iraq — where we are still bombing ISIS troops — and is losing the war in Afghanistan. Each of these wars has lasted longer than the Vietnam war, which began officially with Congress’ Gulf of Tonkin resolution on August 10, 1964.

What we are seeing is a steady reduction of the bang-for-the-buck ratio. The federal government is spending vastly more money on defense, but Presidents are wasting this money on offense — failed offense.

David Stockman has made a fascinating discovery. It has to do with real (inflation-adjusted) final sales in the economy. He regards real final sales as the best indicator of economic growth.

Real final sales, for example, include the national defense spending accounts of NIPA [National Income and Product Accounts], which currently amount to $750 billion. But defense spending generates pure economic waste–even if it does arguably provide for the intangible good called “national security”. That’s relevant because between 1953 and 1971 there was zero real growth in the defense component of GDP.

By contrast, between 2000 and 2014, the real defense spending component grew by 37%.

This indicates a decline in bang for the buck. As the Defense Department absorbs an ever-greater percentage of the federal budget, the results turn increasingly negative: longer wars, but no victories.

We see this in other areas of the economy where the federal government is increasing its control, as measured by spending. One is public education. Another is healthcare. The ratio of federal spending to real output keeps rising, meaning less bang for the buck.

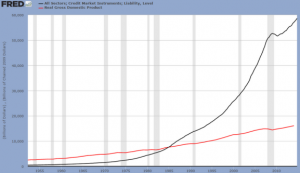

This long-term slowing of the ratio of output-per-government-resource-input is now being matched in the private sector. Consider this crucially important ratio: credit to real GDP. It takes more and more debt to produce a slowing increase in real GDP. Again, I cite Stockman. He has provided a remarkable chart, courtesy of the Federal Reserve Bank of St. Louis. The chart compares credit growth to real GDP. The lines crossed in 1985, the year that Stockman resigned in protest as Director of the Office of Management and Budget, although he did not mention this coincidence in his article. (continue reading)