We are now in the month of April—–so the Wall Street Keynesians are back on their spring “escape velocity” offensive. Normally they accept the government’s seasonal adjustments in stride, but since Q1 is again hugging the flat line or worse, it seems that “bad seasonals” owing to an incrementally winterish winter explain it all away once again. Even today’s punk jobs number purportedly reflects god’s snow job, not theirs.

What’s really happening, they aver, is that jobs are booming, wages are lifting, housing prices are rising, consumer confidence is buoyant, car sales are strong and business is starting to borrow for growth. In fact, everything is so awesome that one Wall Street economist quoted yesterday could hardly contain his euphoria:

“Consumers have emerged from the winter blues. If they spend anywhere as great as they feel right now, then this economy is going to roar over the next few months,” said Chris Rupkey, chief financial economist at MUFG Union Bank in New York.

Since Rupkey has been expecting a roaring economy for several years now it is tempting to dismiss his latest fantasy as just the institutional cluelessness which emanates from the pitiful behemoths which pass for Japanese banks. But with only slightly more enthusiastic bombast, Rupkey is simply braying from the generic Wall Street script.

Since these people get paid a lot, have PhDs and might even be smart, how is it that they are so wrong, and have been now for five years running? There is a simple answer: They are operating on a business cycle model that is utterly erroneous and obsolete; and which therefore distorts and obfuscates the ‘in-coming’ data and the inferences and forward expectations that they derive from it.

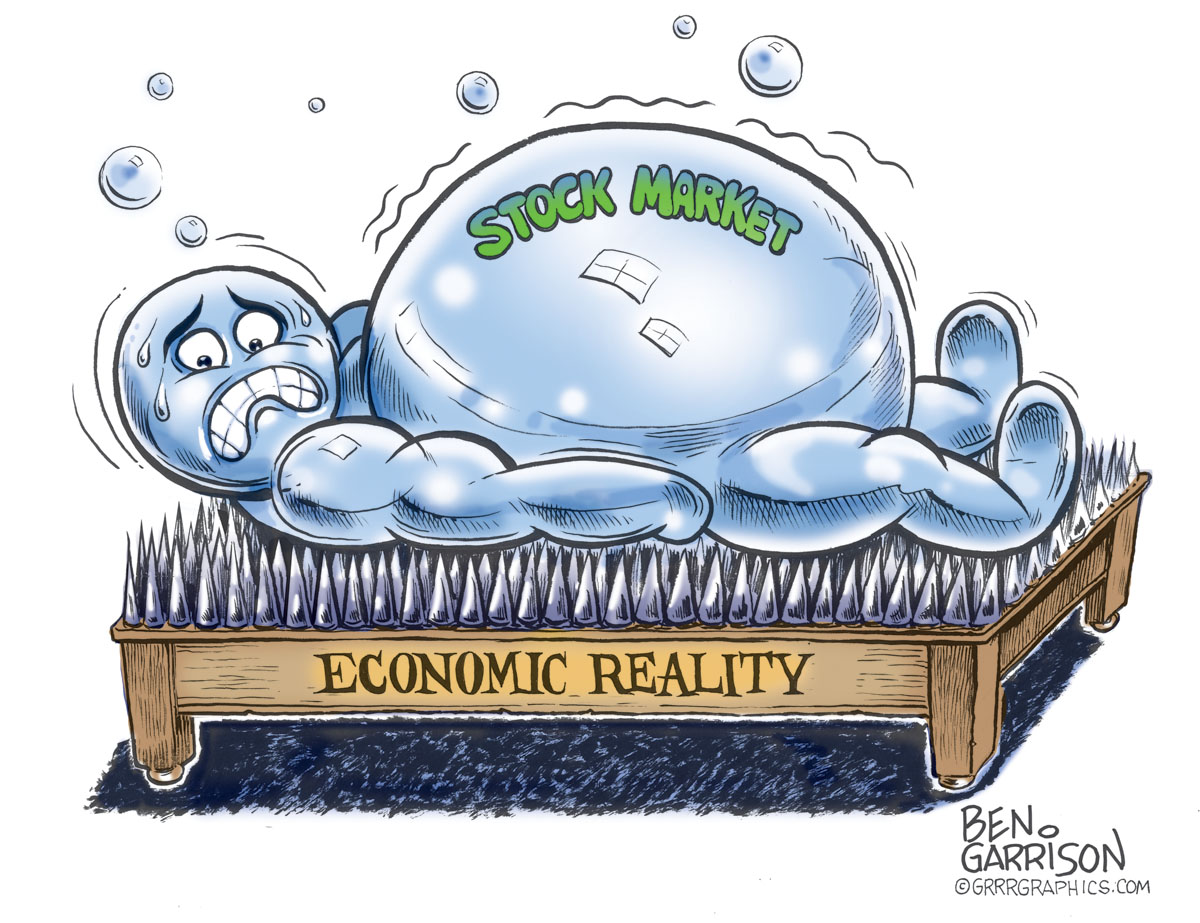

In a word, their father’s business cycle model was premised on a “clean balance sheet” world driven by main street borrowing. In fact, however, we have now passed through the “peak debt” horizon and are in a bubble finance world driven by Wall Street speculation. That passage changes everything.

To be sure, the old fashioned main street cycle was the work of the Fed no less than today’s. After all, the business cycle itself is essentially a product of central banking.

Indeed, central banks function akin to the 12-year old who killed his parents and then begged the court for mercy on the grounds that he was an orphan. That is, they inherently generate credit inflations and the resulting economic boom and bust—–only to then claim indispensability in reversing the recessionary slump and avoiding a plunge into depressionary darkness.

But there were some big differences between then and now….. (continue reading)